Selfwealth Investor Data Details High Conviction Sectors

Selfwealth

Amid the downward slide in Australian and US markets, Selfwealth investor data reveals which sectors and companies are seeing the highest conviction trades.

Most Traded ASX Single Stocks

Pilbara Minerals Limited - PLS

CSL Limited - CSL

BHP Group Limited - BHP

Fortescue Metals Group Limited - FMG

Macquarie Group Limited - MQG

Australia and New Zealand Banking Group Limited - ANZ

Qantas Airways Limited - QAN

Westpac Banking Corporation - WBC

Woodside Energy Group Ltd - WDS

Commonwealth Bank of Australia - CBA

ResMed Inc. - RMD

Core Lithium Ltd - CXO

Whitehaven Coal Limited - WHC

Syrah Resources Limited - SYR

Liontown Resources Limited - LTR

Allkem Limited - AKE

Mineral Resources Limited - MIN

Australian Foundation Investment Company Limited - AFI

Bank of Queensland Limited - BOQ

Sayona Mining Limited - SYA

Pilbara Minerals (ASX:PLS) was the most traded stock within the Selfwealth community. Even after the company’s CEO said it couldn’t compete with Chinese refiners, and the stock subsequently fell short for the month. While Selfwealth investor conviction was high in terms of trade volume with 67% of their trades being buys, trade value tells a different story as only 49% of all dollars flowing through PLS were sells.

Other popular stocks were CSL (ASX:CSL) in second with a whopping 79% of trades being buys, and BHP (ASX:BHP) with only 51% of trades being buys. For the highly traded BHP, this was on par with September conviction, but far below August’s 69%.

Within top 20 most traded list, Fortescue Metals (ASX:FMG) was sold off the most, with 61% of all trades, and 57% of all dollars flowing from sold shares. This comes amid volatility internally and internationally, and the majority of analysts feeding into Selfwealth’s premium research indicating the stock as either a ‘sell’ or ‘strong sell’.

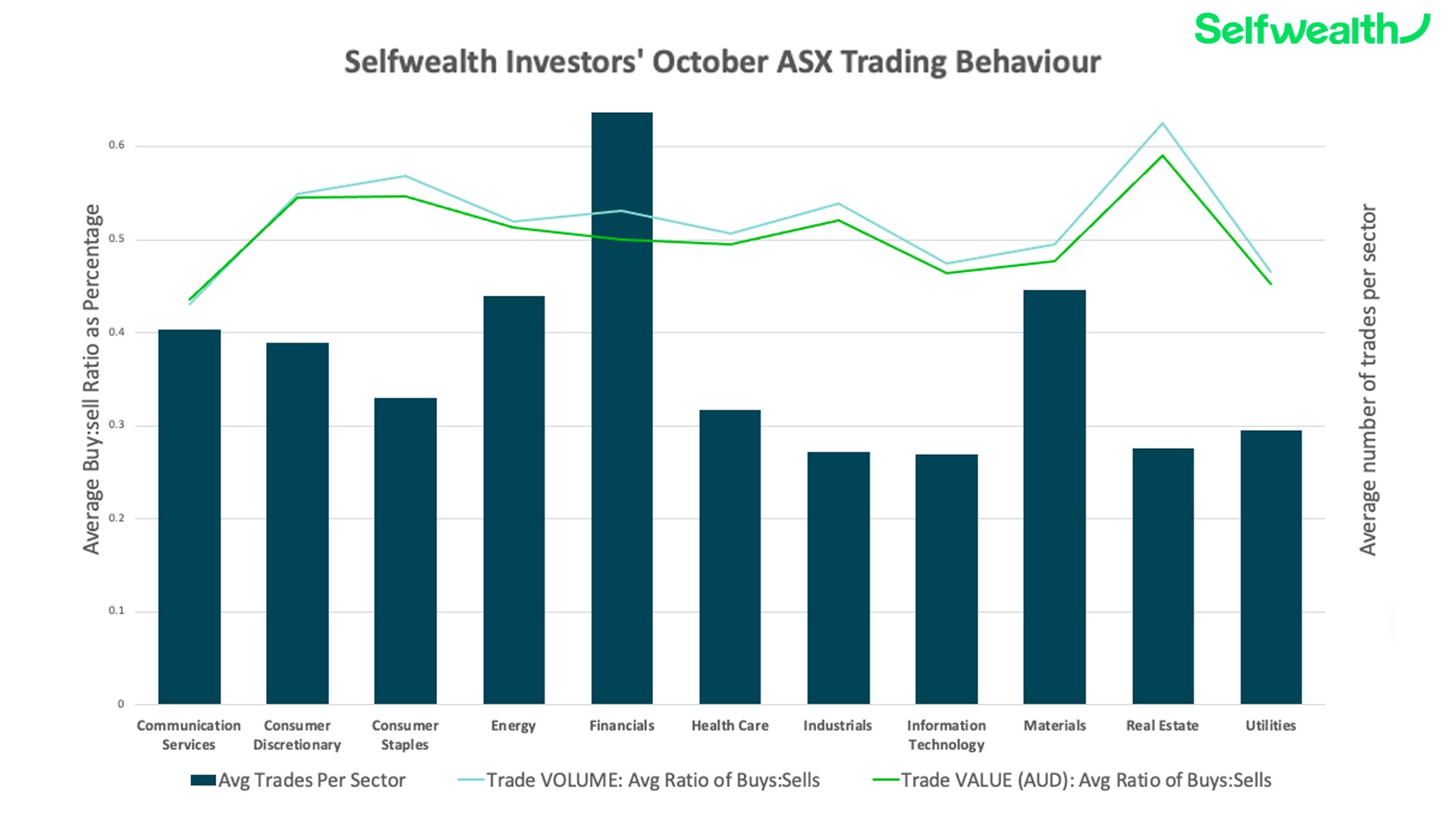

When it comes to ASX sectors, Selfwealth investors favoured Financials. In order, Commonwealth Bank (ASX:CBA), Westpac (ASX:WBC) and ANZ (ASX:ANZ) rounded out the top four, but the most traded Financial stock belonged to Macquarie (ASX:MQG).

Shares in the Materials sector faced varied investor sentiment. Companies like Mineral Resources Limited (ASX:MIN) were favoured, but the likes of Northern Star Resources (ASX:NST), Rio Tinto (ASX:RIO), and Lynas Rare Earths (ASX:LYC) were sold off.

Most Traded US Single Stocks

Tesla, Inc. - TSLA

NVIDIA Corporation - NVDA

Rivian Automotive, Inc. - RIVN

Bank of America Corporation - BAC

Apple Inc. - AAPL

Microsoft Corporation - MSFT

Meta Platforms, Inc. (formerly Facebook, Inc.) - META

Amazon.com, Inc. - AMZN

Alphabet Inc. (Class C Capital Stock) - GOOG

IonQ, Inc. - IONQ

Alphabet Inc. (Class A Common Stock) - GOOGL

Palantir Technologies Inc. - PLTR

Carvana Co. - CVNA

PayPal Holdings, Inc. - PYPL

Advanced Micro Devices, Inc. - AMD

Taiwan Semiconductor Manufacturing Company Limited - TSM

Snap Inc. - SNAP

GameStop Corp. - GME

Morgan Stanley - MS

AMC Entertainment Holdings, Inc. - AMC

On US stocks, Keary noted, “We’re observing resilience among Selfwealth’s US investors, particularly with Tesla (NASDAQ: TSLA) maintaining its position as the platform’s preferred stock despite the company’s recent price dip and earnings miss. This kind of robust trading activity, which increased by 80% month-on-month, along with a rising buy-to-sell ratio, is a testament to the confidence our investors have in the EV market’s long-term potential. Similarly, Bank of America’s (NYSE: BAC) performance impressed Selfwealth investors, evidenced by its climb to become the fourth most traded US stock and the significant uptake in buying interest post-earnings.”

Elsewhere in US tech, Rivian (NASDAQ: RIVN) trades surged, even as its valuation fell by a third, following a $1.5 billion bond offering, with investors buying into the dip, and popular ‘Reddit’ stocks like IONQ (NYSE: IONQ), Carvana (NYSE: CVNA), AMC (NYSE: AMC), and Marathon Digital (NASDAQ: MARA) also captured traders’ interest.

Regarding US ETF movement, Keary called out the performance of one fund in particular: “Amid the broader turbulence in the US tech sector, it’s noteworthy that US tech ETFs like Betashares’ Nasdaq 100 ETF (ASX: NDQ), hold their ground as top contenders in our platform’s collective holdings. Our data reflects a forward-thinking investor base that’s keen to engage with dynamic market conditions, reinforcing our commitment to providing a powerful trading environment.”

Looking to the US, Tesla (NASDAQ: TSLA) remained the favourite among traders on Selfwealth.

Important disclaimer: SelfWealth Ltd ABN 52 154 324 428 (“Selfwealth”) (AFSL 421789). The information contained on this website is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser and/or accountant. Taxation, legal and other matters referred to on this website are of a general nature only and should not be relied upon in place of appropriate professional advice. You should obtain the relevant Product Disclosure Statement for any product mentioned and consider its contents before making any decision.