Selfwealth Most Traded US Stocks: September 2024

Rene Anthony

This article was produced 10 October, 2024.

Key takeaways:

Various Bitcoin-related securities were among the most traded names last month, which aligned with a surge in the price of the cryptocurrency.

‘Alternative’ funds, including inverse funds and those using leverage to increase exposure, drew strong money flow through September.

We highly recommend you always undertake your own research, particularly with Bitcoin which is highly volatile and potentially exposes investors to substantial capital loss.

It is important to always do your own research before making decisions to invest.

The US share market shrugged off a sluggish start to September, ultimately extending year-to-date gains. After months of anticipation, the Federal Reserve finally pivoted to rate cuts, even surprising some corners of the market by slashing rates by 50 basis points.

During the month, the Nasdaq Composite gained 2.7%, the S&P 500 added 2.0%, and the Dow Jones also delivered a positive return, up 1.9%.

Those results continued a theme that has seen technology shares at the heart of the market bull run. How did this influence the Selfwealth community? Let’s take a closer look at the popular trades and key trading themes from last month.

US share trading activity

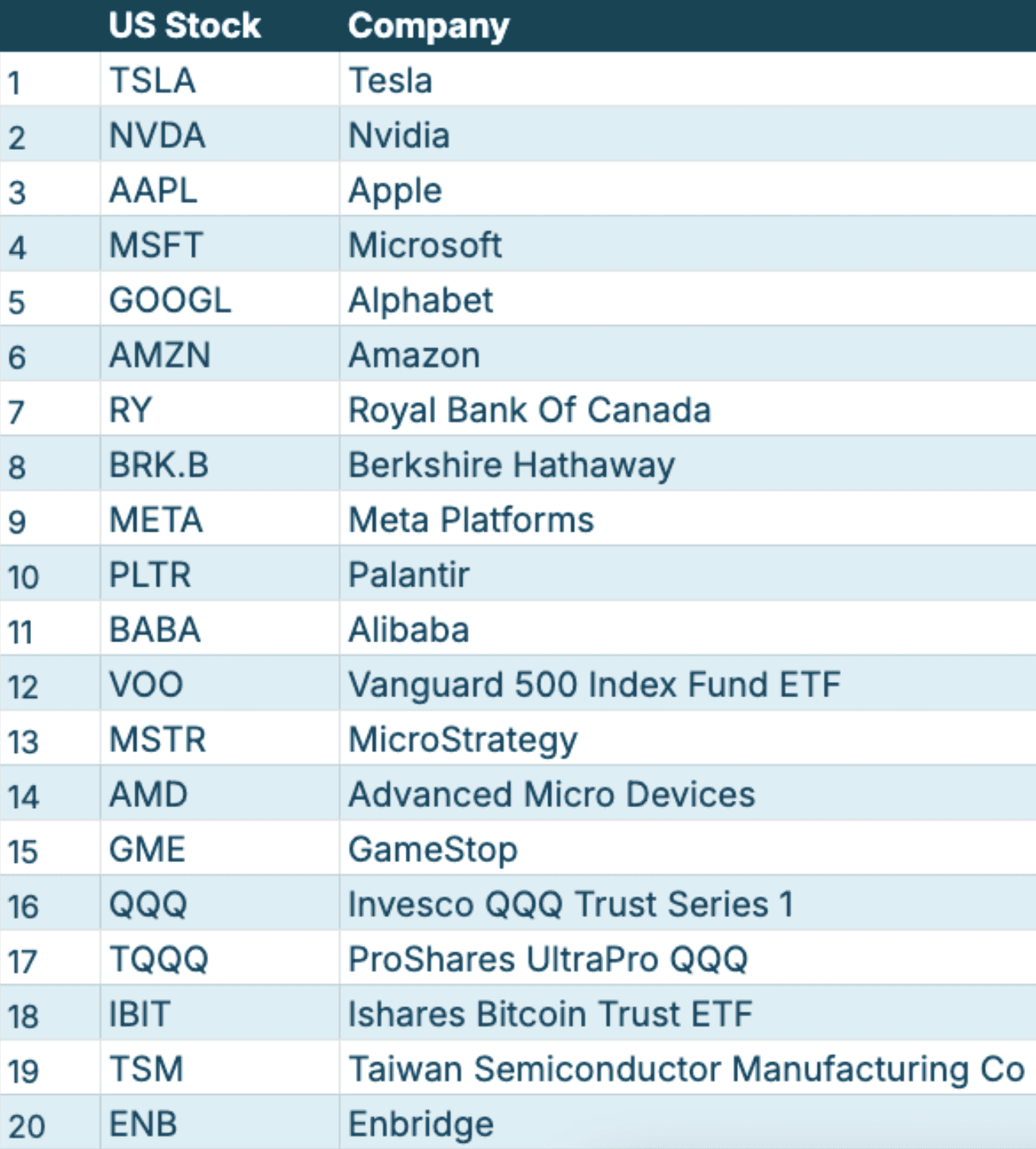

Although trades in Nvidia (NASDAQ: NVDA) dropped off from the stock’s recent high, it was still well and truly the most actively traded name in the Selfwealth community during September. Overall trade numbers in NVDA were roughly five times that of the second most traded stock, and exceeded the combined total of the rest of the shares within the top 20.

On the back of strong buying interest, Palantir (NYSE: PLTR) was the fifth most traded US name last month. Approximately seven out of every ten trades in PLTR were ‘buys’, with buying conviction improving by 15.1 percentage points over the month. Over the last six months, the buy-to-sell ratio for PLTR has averaged 65.9%, which trails only the likes of Nvidia, Microsoft (NASDAQ: MSFT), and Alphabet (NASDAQ: GOOGL) among all regular names in the top 20.

Making only its second appearance, Trump Media & Technology (NASDAQ: DJT) was the 10th most traded US share in September. The last time DJT featured among the top 20 was in June, which coincided with the first US Presidential debate. With this, perhaps it was not all that surprising the stock resurfaced within the community in the lead-up to, and after the second US Presidential debate last month. Shares in DJT shed nearly 18%, but 56.1% of trades made by Selfwealth investors were purchases.

The highest buying conviction was saved for Berkshire Hathaway (NYSE: BRK.B) and MicroStrategy (NASDAQ: MSTR). Three quarters of all trades in the former were buys, while that figure jumped to 84.2% for the latter.

Other notable movements saw Taiwan Semiconductor Manufacturing (NYSE: TSM) climb two spots to 13th, while Broadcom (NASDAQ: AVGO) bolted from outside the top 20 to land in 14th spot. At the same time, both stocks traded within touching distance of their respective record highs.

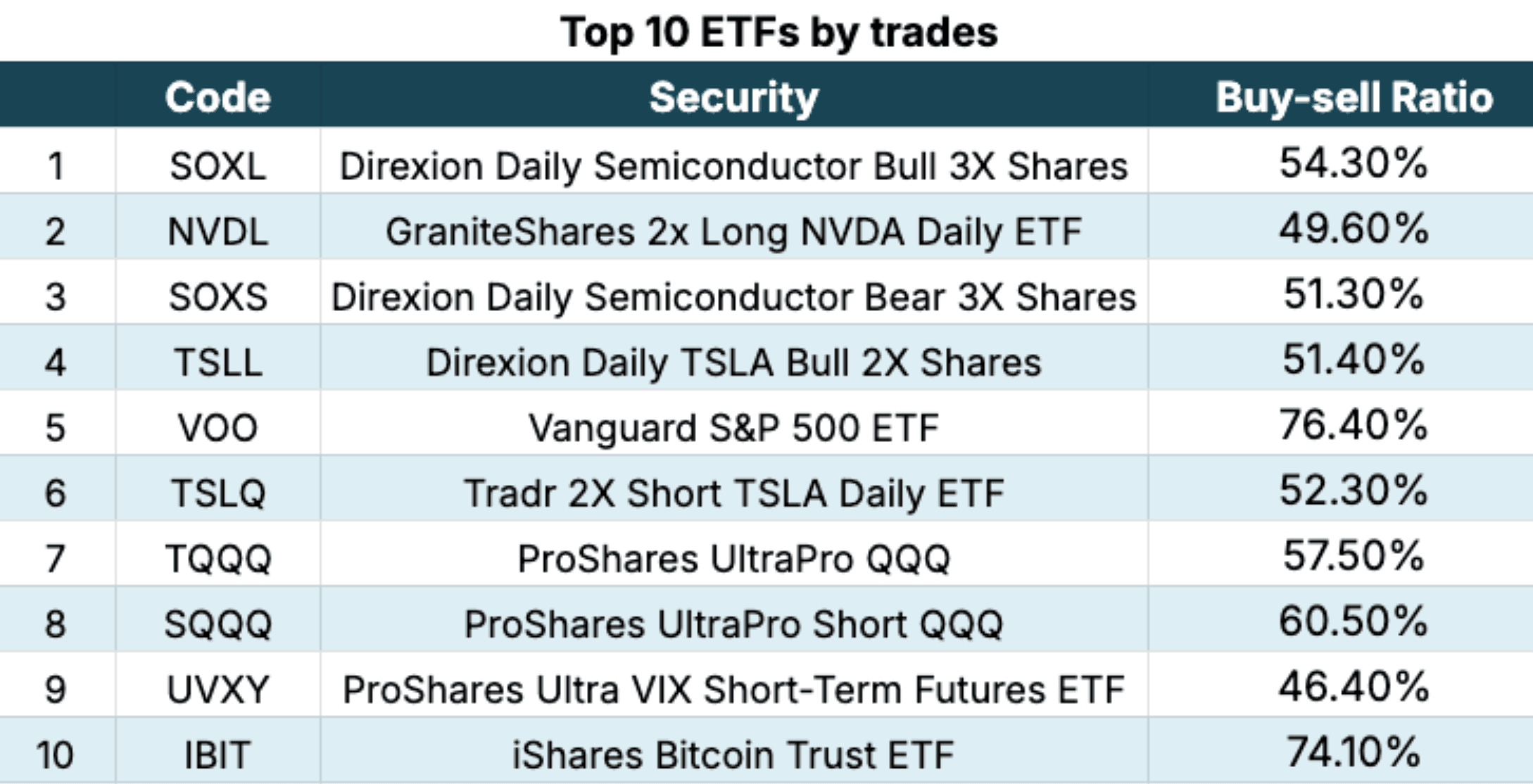

For the most part, trade volumes across the most popular US ETFs were down over the month.

However, one interesting development saw the ProShares UltraPro QQQ (NASDAQ: TQQQ) record a modest 1.4 percentage point increase in buying conviction, but this paled in comparison with the 8.0 percentage point increase in buying conviction for the ProShares UltraPro Short QQQ (NASDAQ: SQQQ).

Although the two figures offer contrasting views around overall sentiment regarding the Nasdaq 100 index, the popularity of these products suggests the index represents just as much of a market barometer for Selfwealth investors to follow as the S&P 500.

While Nvidia found itself again the most traded US stock by value, much of last month’s money flow centred around Tesla (NASDAQ: TSLA).

For the first time, ‘alternative’ Tesla funds attracted greater money flow than the underlying head stock. Both the Direxion Daily TSLA Bull 2X Shares (NASDAQ: TSLL) and the Direxion Daily TSLA Bear 1X Shares (NASDAQ: TSLS) saw more funds shift through the platform than TSLA. Furthermore, for the third time within the space of four months, money flow in TSLA sided with selling activity. This may have had something to do with the stock recording a three-month high, and profit taking may have motivated sellers.

Meanwhile, the trend that saw alternative funds at the centre of large-value trades also stretched to Bitcoin. The ProShares UltraShort Bitcoin ETF (NYSE: SBIT) and the ProShares Ultra Bitcoin ETF (NYSE: BITU) ranked 10th and 14th last month for the most traded US stocks by value. Much of the speculation around Bitcoin prices remains focused on the most recent halving, which historically has prompted a price peak over a year later.

Connected to the above Bitcoin focus, MARA Holdings (NASDAQ: MARA) sustained a high level of money flow, despite slipping to 13th on the list. For the second month in a row, a slight majority of money flow favoured buying activity in the stock.

Wrapping things up, trade values in Alphabet (NASDAQ: GOOGL) and Intel (NASDAQ: INTC) both soared through the month, up 53.6% and 68.4% respectively.

While Alphabet is one of the most popular US shares on the platform, it is less frequently sighted among the most traded stocks by value, instead being a high-volume smaller value trade. Nonetheless, last month saw GOOGL draw its highest total trade value since February 2024. Somewhat similarly, Intel has drawn volume over recent months, particularly in August, albeit the last time the stock commanded such money flow was back in August 2023.

Which US shares are the most held?

Electric vehicle manufacturer Tesla remains the most held US share on the Selfwealth platform. TSLA has maintained this feat since August 2021, with the total value of holdings in the EV stock double that of Nvidia. Last month, the value of community holdings in TSLA grew 16.9%. However, this fell short of the stock’s underlying gain of 22.2% on account of net selling activity.

It is now four months in a row that Palantir has attracted growth in holdings, including the third instance of double-digit growth. In September, the PLTR share price advanced by 18.2%, which placed it within touching distance of an all-time high. The main catalyst for the stock’s rally was news PLTR would be added to the S&P 500. Within the community, PLTR continues to attract more trades from buyers than sellers, albeit the value of ‘sells’ was higher than all purchases last month.

Among the most popular shares, Alibaba (NYSE: BABA) recorded the highest growth in community holdings. The collective value of Selfwealth investors’ holdings in the ecommerce platform surged 33.3%. During the month, Alibaba shares gained 27.3%, which followed an announcement related to the company’s AI models, and various initiatives unveiled by China's central bank to support the world’s second largest economy.

Second only to Alibaba for holdings growth, MicroStrategy recorded a busy month. Holdings growth across the Selfwealth platform was 27.3%, which was exactly in line with the stock’s performance. Higher Bitcoin prices played a role, while the market also responded favourably to new Bitcoin investments.

Other changes saw GameStop (NYSE: GME) move two spots lower to 15th position, while energy pipeline operator Enbridge (NYSE: ENB) rejoined the top 20.

As always past trends and performance are not an indicator of future trends and performance. It is important to always do your own research before making decisions to invest.

That’s all for this Trade Trends report, stay tuned for the next edition this time next month!

Important disclaimer: SelfWealth Ltd ABN 52 154 324 428 (“Selfwealth”) (AFSL 421789). The information contained on this website is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser and/or accountant. Taxation, legal and other matters referred to on this website are of a general nature only and should not be relied upon in place of appropriate professional advice. You should obtain the relevant Product Disclosure Statement for any product mentioned and consider its contents before making any decision.