Selfwealth most traded ASX shares: September 2024

Rene Anthony

Key takeaways:

In keeping with a broader market trend, conviction waned in bank shares late in the month. Meanwhile, various shares from the Materials sector attracted strong buying support.

There were signs that overall market sentiment was somewhat cautious. Money flow across the most popular trades skewed towards outflows, and conviction in ETF trades fell sharply.

With the price of gold resetting its record high on numerous occasions last month, Northern Star Resources became the first gold share to ever feature among the top 20 most held ASX shares on the Selfwealth platform.

The Australian share market ended September at a record high, which followed a 2.2% gain for the benchmark S&P/ASX 200 index.

Materials was the strongest performing sector through the month. Iron ore and lithium were supported by developments out of China, while gold rallied in response to an aggressive rate cut by the US Federal Reserve.

In contrast, the Healthcare and Financials sectors saw a drop-in support late in the month as capital rotated into Materials shares.

These results flowed through to the Selfwealth community, where last month’s trading action led to a shake-up among the most popular names, and various shares gained notoriety for the first time.

As always past trends and performance are not an indicator of future trends and performance. It is important to always do your own research before making decisions to invest.

ASX share trading activity

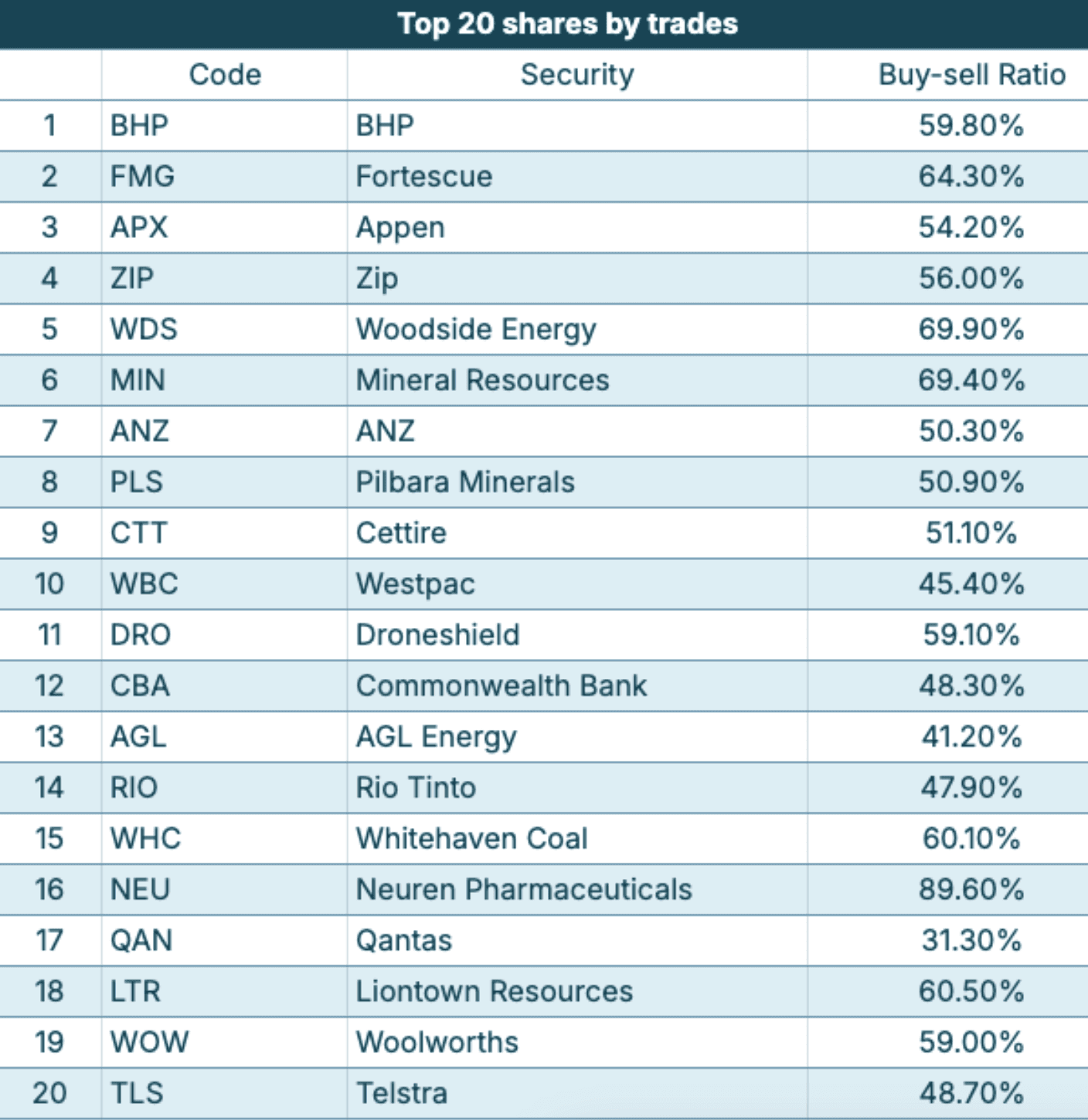

Iron ore heavyweights BHP (ASX: BHP) and Fortescue (ASX: FMG) led trading activity, both by trade volumes and trade values. However, Appen (ASX: APX) held onto third position among the most actively traded ASX shares. Selfwealth trade volumes for APX eclipsed the stock’s former record by 4.6%, with a clear majority of investors buying the stock.

Appen also traded at a yearly high, which follows a period where the company announced strong revenue growth out of China, and then touted its “positive revenue trajectory” in relation to generative AI. As one of just a few ASX-listed shares with direct exposure to AI, it appears a large cohort of the Selfwealth community were attracted to buying shares in the data modelling business.

Zip (ASX: ZIP) was a major mover, climbing from sixth position to fourth place. While trade volumes in ZIP were flat over the month, buying conviction rose 2.5 percentage points. This coincided with the stock trading at a more than two-and-a-half year high. That suggests at least some Selfwealth investors have followed the stock based on momentum. Zip has delivered four consecutive quarters of profits, and its FY24 results showed revenue growth of nearly 30%.

Another strong showing came courtesy of Mineral Resources (ASX: MIN), which moved from the 14th most traded share, to sixth. Overall trades grew circa 69%, with strong buying conviction underscored by the fact that almost seven out of every ten trades were buys. This enthusiasm may have been associated with a rebound in iron ore and lithium prices through September.

Meanwhile, Cettire (ASX: CTT) made an inaugural appearance among the top 20 traded ASX shares, landing in ninth spot. While conviction levels marginally favoured buying activity, the overall number of trades in CTT was a monthly record on the Selfwealth platform.

In September, the luxury fashion retailer published its FY24 results. Despite net profit shrinking by a third, the company’s revenue grew almost 80%. Management expects sales to grow approximately 20% in the first quarter of FY25. This was followed by a near $16 million share purchase by Cettire’s CEO, who took his stake in the business to around one-third of all shares on issue.

Elsewhere, popularity eased in Droneshield (ASX: DRO), with the stock now ranking 11th as opposed to fifth a month prior. In addition, buying conviction declined 5.1 percentage points. In contrast, AGL Energy (ASX: AGL) advanced from 18th to 13th on the back of a 42% increase in trades over the month, despite buying conviction falling 5.8 percentage points.

Finally, Qantas (ASX: QAN) fell from 10th to 17th, with buying conviction slumping 12.6 percentage points over the month. Selfwealth trades in the national carrier contracted more than 36% at a time when the stock traded at a near five-year high.

Regarding ETFs, last month saw an unwinding to the trend from August, with a notable decrease in buying sentiment for exchange-traded funds. On this occasion, the trend extended beyond ASX-oriented ETFs to a broader range of funds.

Except for the Vanguard Australian Shares High Yield ETF (ASX: VHY), and Australian Equities Strong Bear Hedge Fund (ASX: BBOZ), which both recorded modest increases in buying sentiment — the latter indicating a bearish outlook — all other ETFs among the top 10 trades recorded a decrease in buying conviction.

In some cases, like the Betashares Nasdaq 100 ETF (ASX: NDQ), the decline was notable. The monthly buy-to-sell ratio for NDQ fell 7.3 percentage points. Alongside a drop in trade volumes, this suggests some market caution among Selfwealth investors in light of new macro developments. Such developments included expanding conflict in the Middle East, and the uncertain outlook for the US economy as evidenced by an aggressive Federal Reserve rate cut.

In a further sign highlighting at least some desire within the community to de-risk, 12 out of the top 20 most traded shares by money flow recorded a buy-to-sell ratio below 50%.

This meant that there was significant money flow exiting major shares. In addition, one of the eight names where buying conviction prevailed as the majority force was the aforementioned BBOZ ETF. This fund gains as the market falls, effectively reinforcing what was a mixed month as far as overall trading sentiment.

Late in the month, as bank shares started to decline, Selfwealth investors followed the market wide trend. As such, there was reduced exposure to this segment. The buy-to-sell ratios for each of ANZ (ASX: ANZ), Westpac (ASX: WBC), Commonwealth Bank (ASX: CBA), and NAB (ASX: NAB) were all below 50%, underperforming most other securities.

For the first time since December 2023, the Vanguard Australian Shares Index ETF (ASX: VAS) recorded a buying conviction rate below 50%. The buy-to-sell ratio for VAS was 47.3%. This meant that the overall value of trades in VAS ‘sales’ was greater than that of VAS ‘buys’ — a rare occurrence for the most held ETF on the Selfwealth platform.

Outside of ETFs, the share with the highest buying conviction in relation to money flow was Woodside Energy (ASX: WDS). Approximately two-thirds of all money flow in WDS was related to buying activity. During the month, energy prices retreated sharply, and WDS traded at a more than two-and-a-half year low. The sell-off likely underpinned high buying interest in Woodside, as evident on other occasions over recent months where WDS declined.

What are the most popular ASX shares and ETFs?

Commonwealth Bank still holds the top spot for being the most held ASX share on the Selfwealth platform, despite the aforementioned rotation out of banks.

However, one segment that turned out to be a beneficiary of this trend was the mining industry. Major mining shares all gained spots as an inflow of funds poured into this segment. In particular, iron ore gained traction through the month as China announced measures to stimulate its economy. In turn, these measures supported the price of the key steelmaking material.

On the back of the above, BHP moved into third place, up two positions, while Fortescue and Rio Tinto (ASX: RIO) finished the month in ninth and 13th, up three places and one position respectively.

Other movements saw CSL (ASX: CSL) slip one spot to fifth, the lowest ranking for the biotech giant since October 2023. Shares in the company slipped almost 7% last month, with healthcare shares underperforming through the period. One potential explanation for this was the market wide rotation back into resources shares.

Outside of iron ore, the strongest growth in holdings across the community was observed in Pilbara Minerals (ASX: PLS) and WiseTech Global (ASX: WTC). The former was helped by higher lithium prices. One of China's largest lithium mines, accounting for nearly 6% of global supply, closed operations. On the other hand, WiseTech, a logistics software supplier, continued its strong run. Shares in WTC advanced over 15% last month.

Rounding things out, Northern Star Resources (ASX: NST) made an appearance among the most popular shares held within the community for the first time. This is the first time any gold miner has featured among the top 20. The gold producer was helped by record prices for the precious metal, which approached US$2,700 per ounce. NST traded at a four-year high, with Selfwealth investors holding exposure to gold shares largely favouring the company over listed alternatives.

As far as funds, the Betashares Australia 200 ETF (ASX: A200) and Betashares Nasdaq 100 ETF swapped places in fifth and sixth respectively. Growth in community holdings in the former outpaced the latter at 1.4% compared with 0.4%.

It was a similar story for the Vanguard Australian Shares High Yield ETF and the Betashares Diversified All Growth ETF (ASX: DHHF), which remain long-term favourites on the platform.

As always, past trends are not an indicator of future trends and performance. It is important to always do your own research before making decisions to invest.

That’s all for this Trade Trends report, stay tuned for the next edition this time next month!

Important disclaimer: SelfWealth Ltd ABN 52 154 324 428 (“Selfwealth”) (AFSL 421789). The information contained on this website is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser and/or accountant. Taxation, legal and other matters referred to on this website are of a general nature only and should not be relied upon in place of appropriate professional advice. You should obtain the relevant Product Disclosure Statement for any product mentioned and consider its contents before making any decision.