How to understand LICs, and 3 to Watch

Owen Raszkiewicz

Listed investment companies (LICs) like Australian Foundation Investment Company (ASX: AFI), MFF Capital Ltd (ASX: MFF) and WAM Capital Ltd (ASX: WAM) are three of Australia's biggest (and some might say, best) LICs. In our regular Selfwealth Live show I took a look at these 3 LICs and the difference between LICs and ETFs.

What are LICs?

Listed Investment Companies (pronounced "licks") are some of the most popular types of investments on the ASX for yield-focused investors.

A LIC is a company that's specifically created to invest in other companies, shares, debt markets -- or, really, just about anything. For example, you could have a LIC that invests in gold. In this example, technically, you wouldn't own the gold yourself -- but you would own shares in the LIC (because it's a company) which in turn owns the gold bars.

A LIC is formed and operates in much the same way any company does:

A bunch of management personnel decide to start a company

The company is registered with the Government

Management has a strategy to grow (e.g. a business plan, an investment strategy, etc.)

They raise capital through an IPO or Initial Public Offering by getting investors to swap some shares for cash

The company takes shareholder money and invests on their behalf

The key step is #4.

That is, the initial investors during the IPO of the company/LIC are the ones who put their money into the company's bank account. After that, when an investor sells his or her LIC shares, your money comes from another investor who wants to buy your shares (via the stock market).

For example, if I started a LIC/company called 'Owen Rask LIC' and said to you, "do you want me to invest, say, $5,000 for you? We're about to IPO our new company, so I'm looking for investors who want to buy shares in my newly formed company. If you buy $5,000 worth of shares now, I'll give you $5,000 worth of shares, and use the money to invest on behalf of you and my shareholders."

When you decide you want to sell, you would have to find a buyer for your shares. But the company would still keep ahold of the original investment. It's the same type of thing when you sell your BHP shares -- the company doesn't give you $5,000 -- another investor is buying your shares.

The important thing to remember is that the first investors (e.g. during the IPO) put their money 'inside' the company/LIC. After that, any buying or selling on the ASX is just transferring shares back and forth between investors.

Are LICs different to ETFs?

There are two vital differences between LICs and ETFs you must understand.

Tax

LICs are 'companies', so you own 'shares'.

An ETF is a 'trust', so you get 'units'.

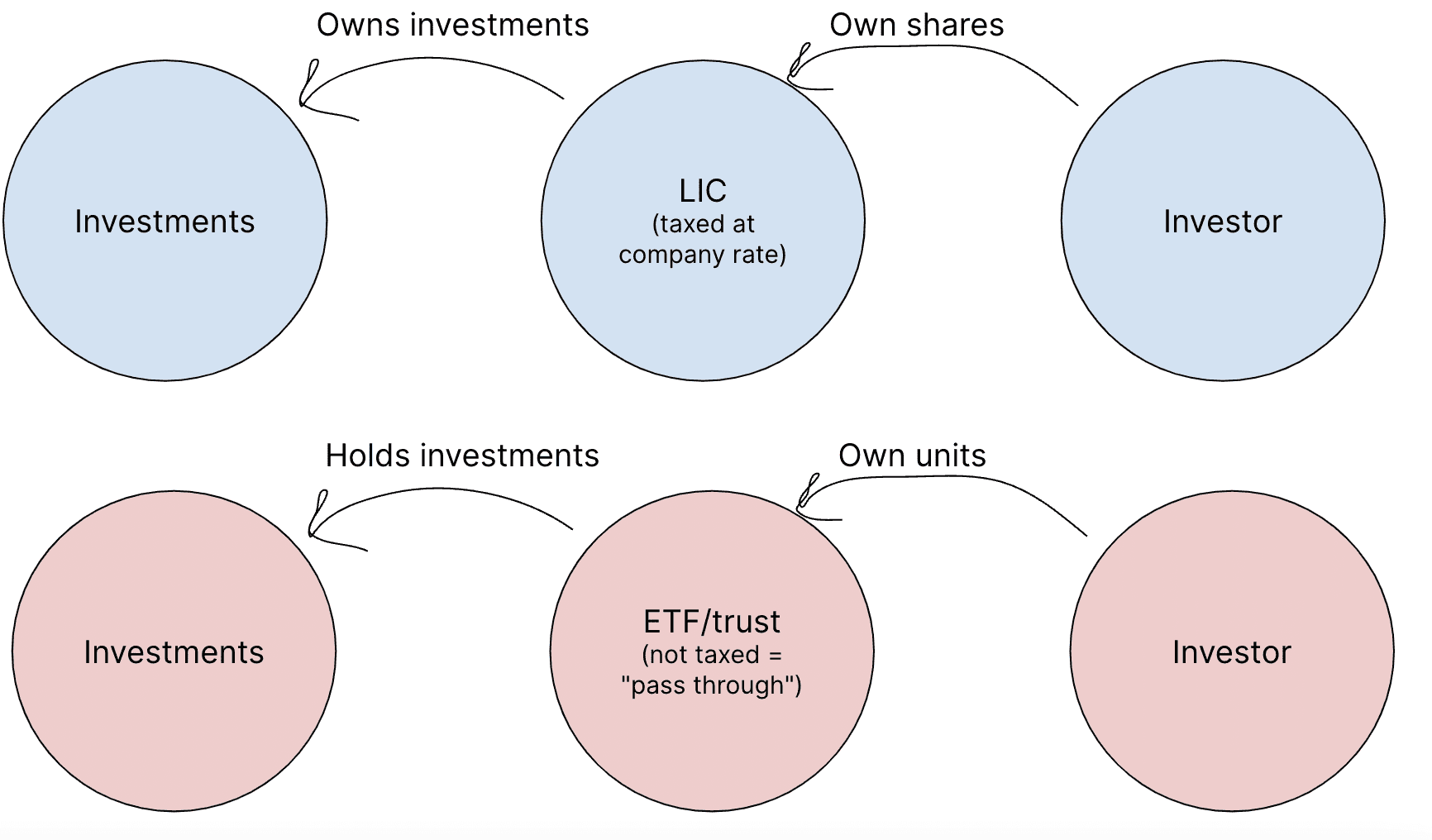

Meaning, they are different legal structures -- and the key difference is how they are taxed. See the middle circle of the following flowchart.

Source: Owen Rask

In the chart above, you can see that a company/LIC is taxed (e.g. at 30%) and because it owns the investments (not the investor) a LIC is not obligated to 'pass through' all of the profits or dividends it receives from the investments inside its portfolio back to the investor. Because it pays its own tax in Australia, a LIC can generate its own franking credits -- as well as collecting the franking credits it receives from its portfolio.

You can also see that an ETF/trust is not taxed because all it does is "hold" onto the investments on behalf of the investor. Therefore, the investor is 'passed through' all of the income tax that is due in a given year, as well as any capital gains (which occur when the ETF sells an investment for a profit). Because an ETF is not taxed it does not generate its own franking credits, however an ETF can 'pass through' franking credits it receives on the investment portfolio.

Since an ETF/trust is legally required to send tax back to its investors, a LIC can be more tax effective for highly taxed shareholders because the LIC manager can control when tax is paid and passed back. Some LICs, like AFIC, also are part of the DSSP system -- which would be extremely interesting for some shareholders.

Active versus passive

Secondly, most LICs use active investment strategies, run by a team of professionals. Whereas 'many' (but definitely not all) ETFs use a passive or thematic index style strategy. This is reflected in the higher fees (and performance fees) typically charged by LICs compared to ETFs.

When I use LICs

When I'm building a Core portfolio, I almost always prefer to use an ETF for the Core/large part of our portfolios. ETFs tend to be lower cost and are fully transparent with all of their holdings (anyone can see what's inside a passive ETF, on the ETF provider's website).

That said, there are times when the legal/tax structure of a LIC makes more sense (e.g. when investing into markets without daily liquidity or harvesting franking credits). For example, with private market investments (e.g. when private companies are owned by a LIC), in micro caps or small caps, I find LICs to be quite interesting because they don't suffer from the daily liquidity requirements of an ETF (this is why most ETFs won't invest in small cap Aussie shares -- the shares are too small for the ETF).

For most of the other stuff, such as when I'm investing in blue chip shares, overseas markets, or things like bonds, an ETF is my preferred exposure (or I'll just buy some shares directly). To be clear, nearly all of my Core portfolio is ETFs. The same can be said of all of the portfolios we build for Rask members.

However, LICs are still a very tasty satellite alternative for shrewd investors.

To learn more, tune into Selfwealth Live every Wednesday night at 6 pm Australian Eastern Time, or watch the video above.

Cheers!

Owen Rask

Disclaimer: This article contains general financial advice only. It is not personal financial advice as it does not take into account your needs, goals or objectives. So please speak with a financial adviser before acting on this information. - Important Disclaimer: SelfWealth Ltd ABN 52 154 324 428 (“Selfwealth”) (AFSL 421789). The information contained on this website is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser and/or accountant. Taxation, legal and other matters referred to on this website are of a general nature only and should not be relied upon in place of appropriate professional advice. You should obtain the relevant Product Disclosure Statement for any product mentioned and consider its contents before making any decision.