3 reasons ASX small-cap shares are exciting

Owen Raszkiewicz

We've all seen the scene from The Wolf of Wall Street where Leonardo DiCaprio (playing Jordan Belfort) is hustling unsuspecting investors over the telephone, selling them "pink slips" (shares that aren't large enough to trade on established stock exchanges like the NYSE or NASDAQ).

And we've heard the stories of Wall St banking millionaires getting rich by selling empty dreams and broken promises of untold stock market riches.

What the latest Selfwealth live: Small-cap investing with Andrew Page

At the smallest end of the stock market is a land where many of these, fortunately mostly fictional, stories unfold. Down the bottom of the Australian stock exchange we find the 'Wild West' of ASX investing known as small caps. A small cap is a name given to smaller companies, as measured by the company's market capitalisation (value of all shares in the company combined).

In Australia, a small-cap company is considered to be any company below $300-400 million. However, there are no hard-and-fast rules. In the US, for example, a small-cap might be considered a company that has a market cap of $10 billion - what we in Australia might call a "mid cap".

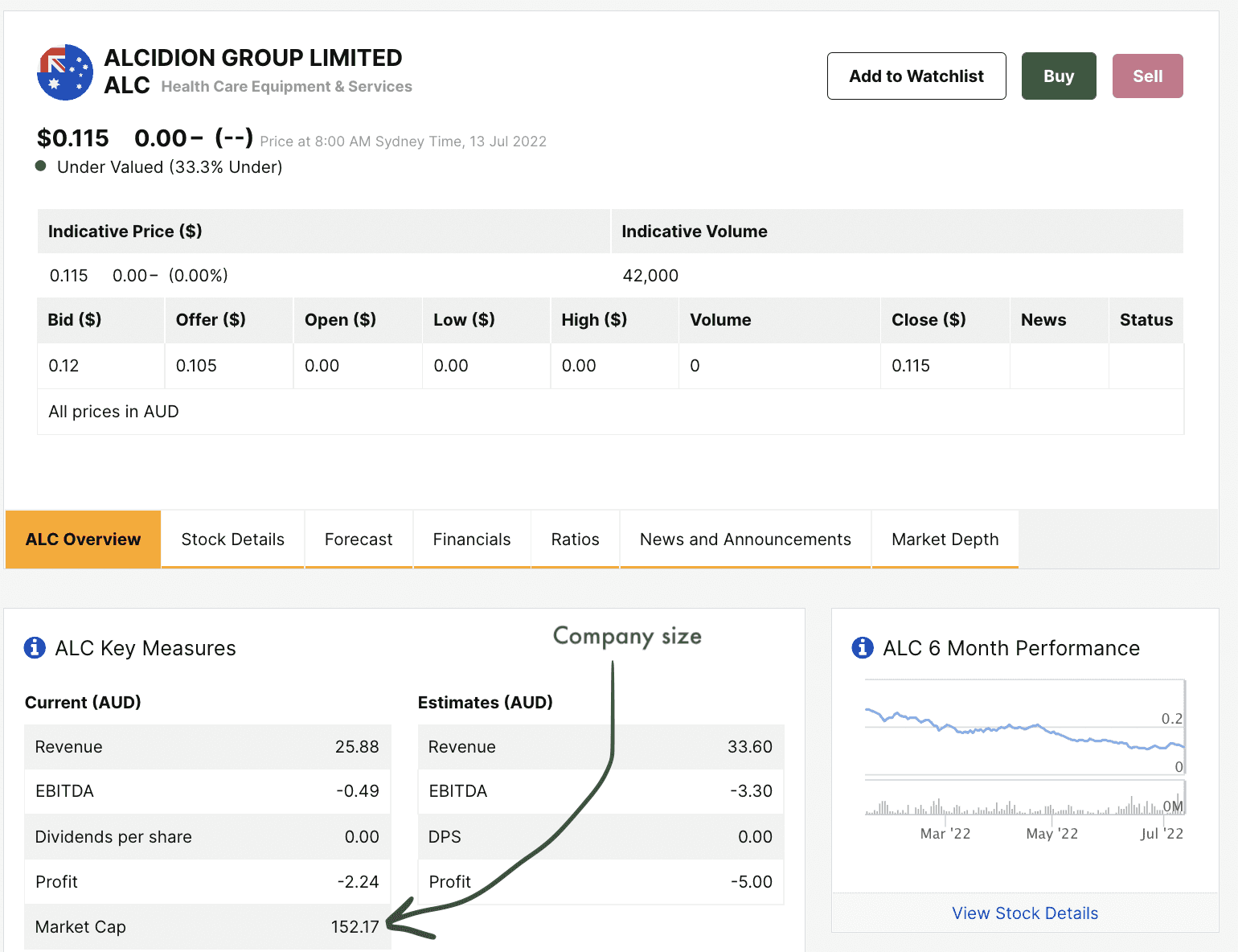

To put the numbers in context, Telstra (ASX: TLS) is a blue chip or "large cap" with 20,000+ employees (its market cap is around $45 billion). Cloud accounting software provider Xero Limited (ASX: XRO) has around 4,500 employees (its market cap is $10 billion). And health technology business Alcidion Group Ltd (ASX: ALC) has around 150 employees, according to Linkedin profile (its market cap is $152 million).

Inside Selfwealth you can see the market cap of Alcidion. If you and I walked down the street and looked at a company's office building and saw that it had 150 employees, we would probably say, "wow, that's a big business." That's because most private businesses in Australia are small businesses (less than 20 employees). So, again, context matters. Alcidion is a massive company by local business standards, but it is a tiny little company by global stock market standards (some companies, like Amazon, have more than one million employees!).

Risks of small company investing

Broadly, there are a few risks when investing in small companies. This list is by no means exhaustive but they apply to almost every type of small-cap company I come across.

Volatility. Shares in many small companies could rise or fall by 10%, 20% or even 30% in a day or two, sometimes without any news. This intense volatility is what makes small caps far too risky for many investors.

Liquidity. This is the risk that occurs when you are unable to buy or sell ("trade") shares in a company at a price that is reasonable, or if you simply cannot get a full position. For example, some truly small ASX companies have only $2,000 of shares available to buy -- and sometimes none at all. This means it could be almost impossible to buy a large position, and when it comes to selling your shares the opposite is true -- it can be near impossible to sell out quickly.

Business execution. In a small-cap company there can sometimes be only 10 - 30 employees, even if it is listed on the stock exchange, so the business' growth or performance is often dependent upon only a handful of key people -- maybe even just one (the founder or CEO). In addition, many small-cap companies have only one core product or service in a select number of markets, so the future of the business may be dependent on a narrow set of regulations, licences or customers.

Ultimately, every small company will have its share of risks. But small companies are often prone to these three risks more than their larger peers.

So why on earth would an investor even consider smaller companies? Let's take a look at some of the reasons why...

3 reasons to consider small-cap investments

To be sure, small company investing is not for everyone. This is why it's usually only professionals or investors with 5-10 years+ experience who venture down here (and survive a full market cycle). Nonetheless, here's what makes it interesting...

Growth potential.

It sounds obvious but there are over 2,400 shares listed on the ASX, and most of them fall outside the top ASX 200 or ASX 300 indices, which include 200 and 300 companies, respectively. Moreover, Australia's marketplace for a company's goods or services is quite limited.

Whereas American companies can grow into a market of 300-400 million people, plus North and South America -- and then take on the world as much larger companies -- Australian companies are far more limited in the size that they can grow in our own backyard.

This is why many investors look further down the market cap spectrum to small companies for growth. Plus another way, it's easier for a $150 million company to grow into a $450 million company (300% increase) than it is for a $10 billion company to grow into a $30 billion company. By way of example, Xero is one of the rare overseas success stories, and most of its business is now done outside of Australia.

One investor's trash is another's treasure

Investing is funny. If most investors believe that a company is too expensive, it might not be (because most people aren't buying it). Likewise, if small-cap investing is too risky for most investors, it opens a door for shrewd investors who are prepared to take the risk.

For example, since many small cap investors will look at companies that suffer from a lack of available shares to buy (liquidity risk) that itself creates an opportunity for investors who don't want to buy many shares (e.g. if you want to buy only $2,000 of shares, you might still look at an illiquid company). It also means fewer professionals are looking at small caps -- because why would they bother researching a company if they can't buy enough shares for their fund. Combined, this means there are fewer investors stalking for opportunities in small caps, making unique insights easier to find.

Diversity in sectors and themes. The big end of town is dominated by banks (CBA, Westpac, etc.) and resources companies (BHP, Rio, etc.). The top 10 companies make up over 35% of the ASX 200. That means the Aussie market is both top-heavy and narrowly concentrated on a few sectors (resources and banks), which won't suit everyone.

By looking outside the 'usual suspects', you have more to choose from -- over 2,000 companies in fact. While many of them are unprofitable or from sectors you won't like (resources exploration, biotech, etc.), there are probably 100 - 300 interesting smaller businesses in fields like software, industrials, agriculture, technology and so on.

For shrewd investors, there are simply more ideas crossing your desk when you have more to choose from. For example, Envirosuite (ASX: EVS) is a small-cap company that offers software for environmental monitoring, to customers around the world. It's probably the ASX's leader in environmental intelligence technology, yet you won't find it in the ASX 200 or ASX 300.

Summary

Small companies can be risky, which is why they're often reserved for less than 5% of a diversified portfolio (in total). However, when we consider the vast opportunities, lack of coverage by professionals (causing mispriced shares) and raw growth potential, it's easy to see why so many long-term investors spend a lot of their time digging for hidden gems in ASX small caps.

Owen Raszkiewicz is the Founder of Rask, a platform helping Aussies invest better. You can take a free course on Rask Education, or follow Owen on Twitter and Instagram.This article contains general financial information only, issued by The Rask Group Pty Ltd. The information does not take into account your needs, goals or objectives, so please speak to a financial adviser before acting on the information.

Important disclaimer: SelfWealth Ltd ABN 52 154 324 428 (“Selfwealth”) (AFSL 421789). The information contained on this website is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser and/or accountant. Taxation, legal and other matters referred to on this website are of a general nature only and should not be relied upon in place of appropriate professional advice. You should obtain the relevant Product Disclosure Statement for any product mentioned and consider its contents before making any decision.